You got into the events industry because you’re: a creative at heart, a people-lover, or a hobbyist-turned-pro— perhaps all three! Suddenly, you’ve found yourself as the owner and operator of a thriving business. But, to maintain a successful operation, you have to make the best financial decisions. While we love what we do, we’re also responsible for feeding not only ourselves and our families, but our employees and their families as well. We sat down with Luna Tolunay, Owner of Fun Planners, to learn more about how event professionals can stay on budget and make good event business financial decisions.

Strategize and set your budget

When you’re determining your budget, you’ll take a few things into account, including:

- Market fit – How do you position your business within your niche?

- Competition – Where are your competitors putting their money?

- Seasonality – When are you fully booked, and when are clients scarcer? We like to phrase this as, “Don’t sell soup in the summer,” meaning don’t spin your wheels (or spend your money) on unpromising avenues when the timing isn’t right. Instead of trying to sell tons of soup when it’s blazing hot outside, save your money in the summer, and then double down in the cold winter months. For you, this may mean going full speed ahead during the wedding season, and cutting back during the slower months.

- Costs – Where do you spend your money? This includes inventory, but also wages, marketing, and other overhead costs.

While it’s important to set your budget for the now, you want to be looking ahead to the future as well. Luna reminds us of a hard truth: Just because an event brings in a lot of revenue or is fun to do, doesn’t mean it’s profitable. She says, “You have to understand your projections and how to read your profit and loss statements. As you’re growing your company, you have to look back at your events and see how things were profitable, where things were not profitable, and tweak your company that way. If you’re doing a type of event that’s not profitable, either you need to adjust your pricing, adjust how you’re doing it, or maybe not do it at all.”

Revisit your budget periodically

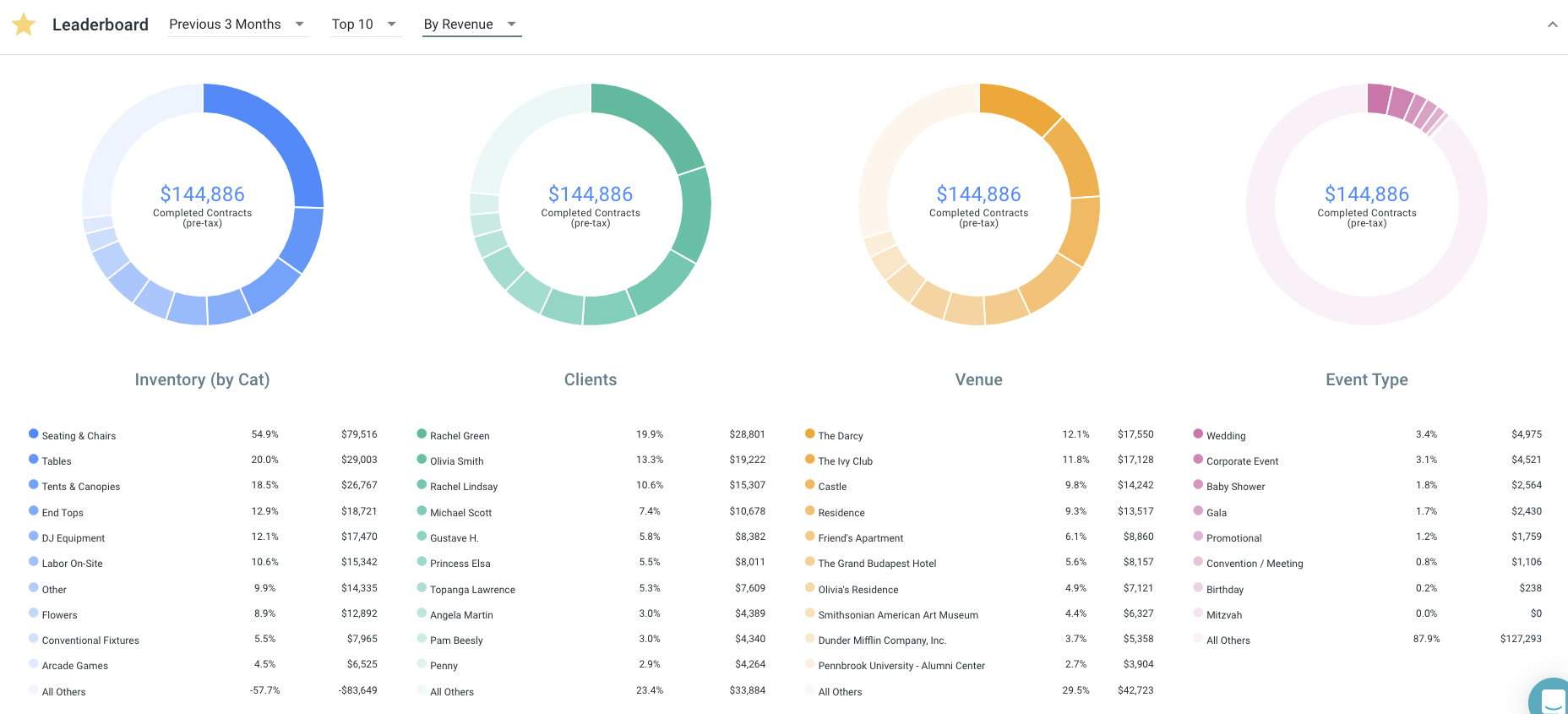

Your budget will naturally change as your business fluctuates. Whether your business is growing or contracting, your budget should change to reflect this. At Fun Planners, Luna revisits her budget quarterly. In this quarterly budget review, she and her team look at what they’d projected, where they landed, and how the projections over the next 6-12 months look. Depending on the numbers, they’ll allocate different amounts of funds toward different areas, such as staffing if they need more hands on deck, or inventory if there’s a huge demand for certain items. She uses Goodshuffle Pro’s reporting features to make these strategic decisions in order to keep her business healthy and growing.

Don’t fall victim to these common mistakes

Unfortunately, there are loads of costly mistakes event professionals can make when it comes to finances. Avoid these potentially disastrous mistakes for your business:

Not knowing your costs

As simple as this may sound in theory, this is one of the most common financial mistakes event professionals make. Don’t be blinded by revenue: fix your sites on profit. A $50k invoice may sound amazing on the surface, but if it costs you $45k to put on the event, it may not be worth it. Another mistake event professionals make is thinking your costs are JUST what you paid for your inventory items and your team’s wages. In reality, your costs also include your time, as well as “smaller” details that really add up, which include fuel, truck maintenance, permits, and more.

Discounting too often

We all wish we could give everyone the event of their dreams — even if it’s not in their budget. So many of us are guilty of lowering our prices because a client tugged at our heartstrings. While this may make you feel good, it can be disastrous for your business if it gets out of control. Be confident in your prices and value, and learn when to give and avoid discounts to keep return on investment, or ROI, high.

Additionally, you may place emphasis on donating a portion of your revenue to charities and nonprofits. Luna suggests budgeting a certain amount of money to go towards these donations each quarter. She says, “Don’t just give to everyone who comes to your door. Make a plan of [the organizations] you want to support, what types of nonprofits, etc. Then, make a budget for it with a percentage of your profits that you want to give back, and have your team monitor this.”

Suffering from a significant amount of disputes and refunds

Disputes, which occur when a client contacts their bank and says they refuse to pay your event company for an event you did, can be a nightmare for event rental businesses. After you spend time, money, and effort on an event, the last thing you want is to not be paid. Being out thousands of dollars on an event can be disastrous for your business. Avoid giving refunds when possible by protecting your business from legal trouble — learn more about how to prevent disputes now.

Not accounting for rainy day situations

Whether it’s your annual slow season or an unexpected force like COVID-19, you should prepare your business as best as possible for rainy days. Keep savings in the bank for these situations so you’re not left out to dry when business is slow.

Make the best financial decisions for your business

Now that you’re armed with best practices for budgeting, as well as common mistakes to avoid at all costs, you’re ready to tackle important financial decisions head-on. While we all wish we could only focus on the creative side of things, we have businesses to run at the end of the day. We need to make money to pay the bills and keep our clients happy — time to go forth and conquer!

Fun Planners has been providing Florida with the finest entertainment, equipment, and services for over 15 years. They started out as a small Casino company in the 1980’s, providing only the best and highest quality equipment and staff. Over time (mostly by request from clients), they have expanded their services into many other areas.